Exploring Medicare Advantage Plans

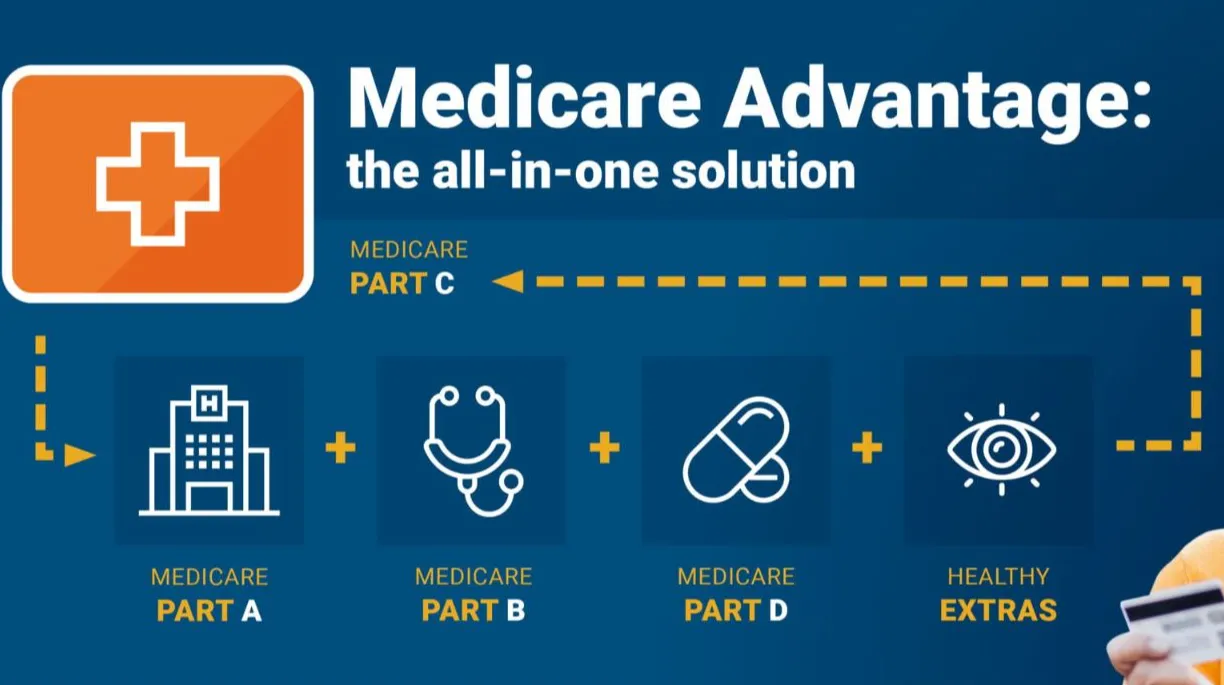

Medicare Advantage Plans are provided by non-government Insurance companies that partner with Medicare to provide Part A along with Part B benefits in one coordinated format. Different from Original Medicare, Medicare Advantage Plans frequently include additional coverage such as prescription coverage, oral health care, vision services, plus wellness programs. These Medicare Advantage Plans operate within specific coverage regions, so residency a key consideration during evaluation.

How Medicare Advantage Plans Differ From Traditional Medicare

Traditional Medicare offers broad medical professional availability, while Medicare Advantage Plans typically rely on organized provider networks like HMOs alternatively PPOs. Medicare Advantage Plans often require provider referrals and/or in-network facilities, but they often offset those limitations with predictable out-of-pocket amounts. For countless beneficiaries, Medicare Advantage Plans deliver a balance between cost control & expanded benefits that Original Medicare alone does not usually deliver.

Which individuals Should Consider Medicare Advantage Plans

Medicare Advantage Plans attract beneficiaries seeking organized healthcare delivery plus expected cost savings under one unified plan structure. Seniors managing long-term medical issues often choose Medicare Advantage Plans because connected care models streamline treatment. Medicare Advantage Plans can further appeal to enrollees who want bundled services without handling separate additional coverages.

Eligibility Requirements for Medicare Advantage Plans

To enroll in Medicare Advantage Plans, enrollment in Medicare Part A in addition to Part B is required. Medicare Advantage Plans are accessible for the majority of people aged 65 plus older, as well as under-sixty-five individuals with qualifying medical conditions. Participation in Medicare Advantage Plans is based on residence within a plan’s coverage region together with timing that matches authorized sign-up windows.

Best times to Choose Medicare Advantage Plans

Timing has a critical role when joining Medicare Advantage Plans. The First-time Enrollment Period surrounds your Medicare qualification date also enables first-time selection of Medicare Advantage Plans. Overlooking this window does not automatically end access, but it often change available options for Medicare Advantage Plans later in the calendar cycle.

Yearly plus Special Enrollment Periods

Each autumn, the Annual Enrollment Period permits enrollees to switch, drop, with enroll in Medicare Advantage Plans. Special enrollment windows open when qualifying events happen, such as moving and also loss of coverage, making it possible for adjustments to Medicare Advantage Plans beyond the normal timeline. Knowing these periods supports Medicare Advantage Plans remain accessible when circumstances evolve.

How to Evaluate Medicare Advantage Plans Successfully

Evaluating Medicare Advantage Plans demands focus to more than monthly premiums alone. Medicare Advantage Plans vary by network structures, annual spending limits, drug lists, as well as benefit conditions. A careful analysis of Medicare Advantage Plans helps aligning healthcare needs with coverage structures.

Costs, Coverage, plus Network Networks

Recurring costs, copayments, along with yearly limits all influence the value of Medicare Advantage Plans. Some Medicare Advantage Plans offer reduced premiums but increased out-of-pocket expenses, while others emphasize stable spending. Provider access also differs, which makes it important to confirm that preferred providers participate in the Medicare Advantage Plans under evaluation.

Prescription Benefits plus Additional Services

A large number of Medicare Advantage Plans include Part D drug benefits, simplifying prescription handling. Outside of prescriptions, Medicare Advantage Plans may include fitness programs, ride services, in addition to PolicyNational.com Medicare Advantage Plan options OTC allowances. Assessing these elements helps ensure Medicare Advantage Plans fit with daily healthcare requirements.

Joining Medicare Advantage Plans

Registration in Medicare Advantage Plans can occur digitally, by telephone, in addition to through licensed Insurance Agents. Medicare Advantage Plans call for correct personal information in addition to confirmation of eligibility before activation. Submitting registration accurately avoids delays as well as unplanned coverage interruptions within Medicare Advantage Plans.

Understanding the Role of Licensed Insurance Agents

Licensed Insurance Agents help interpret plan specifics together with describe differences among Medicare Advantage Plans. Consulting an expert can resolve provider network restrictions, benefit limits, also expenses associated with Medicare Advantage Plans. Expert assistance frequently simplifies the selection process during enrollment.

Typical Mistakes to Watch for With Medicare Advantage Plans

Ignoring doctor networks details stands among the frequent issues when evaluating Medicare Advantage Plans. Another problem involves concentrating only on monthly costs without reviewing total spending across Medicare Advantage Plans. Examining coverage materials carefully reduces misunderstandings after sign-up.

Reassessing Medicare Advantage Plans Every Year

Healthcare needs shift, and also Medicare Advantage Plans update each year as well. Evaluating Medicare Advantage Plans during open enrollment enables adjustments when coverage, costs, and/or doctor access shift. Consistent evaluation ensures Medicare Advantage Plans matched with existing healthcare priorities.

Why Medicare Advantage Plans Keep to Grow

Participation data demonstrate rising interest in Medicare Advantage Plans across the country. Expanded coverage options, structured out-of-pocket caps, in addition to managed healthcare delivery support the growth of Medicare Advantage Plans. As options multiply, informed evaluation becomes increasingly essential.

Long-Term Value of Medicare Advantage Plans

For many beneficiaries, Medicare Advantage Plans deliver consistency through integrated benefits not to mention managed care. Medicare Advantage Plans can reduce management complexity while encouraging preventative services. Identifying suitable Medicare Advantage Plans creates confidence throughout retirement years.

Evaluate and Sign up for Medicare Advantage Plans Now

Taking the right move with Medicare Advantage Plans opens by exploring local options also checking eligibility. If you are new to Medicare as well as revisiting current coverage, Medicare Advantage Plans present versatile solutions created to support varied healthcare needs. Review Medicare Advantage Plans today to identify a plan that fits both your medical needs along with your budget.